Performance of the Model Portfolio (internal archive, not to be published on Hedged.biz)

In 2008, as investors fled in panic, and we ourselves had to raise cash on behalf of investors, we thought to ourselves: how would we manage our own money? Partner’s money. Assuming that everyone was thinking straight.

The result of this experiment has been a model portfolio of hedge funds which we have tracked since the world changed in late 2008. And the world has changed, neither for the better or worse, but changed all the same.

I will present the performance last, because performance is but one measure of ability, it is backward looking and it is the confluence of skill and luck, the partial contributions of which are not always clear, even to experts.

Our Method:

We have always managed to a set of principles we hold dear.

We will understand our investments, and in particular the risk, to our own satisfaction. We will understand each strategy almost as well as the practitioners themselves, at least from a procedural point of view, and often beyond that. We aim to understand a strategy sufficiently well that we can derive our own opinions on particular trades and trade expressions, that we can suggest and challenge the investment ideas of our managers.

There are no hard and fast rules. Each investment is a combination of markets, systems, and people; and the moment you introduce humans, every situation is different. There is no dogma here.

The rest of the process is what you find in the garden variety fund of funds.

The only difference between managing our own money and third party money is that with our own money, we will take a view on nepotism, independence of valuations, higher volatility strategies, lack of track record, etc. We will never take a view on independent administration, independence of the board, and proper corporate governance, with anybody’s money.

2010 Strategy Review

We did say at the beginning of 2010 that it would be a difficult year. The arbitrage profits available from the crisis in 2008 had largely been eked out. Equity valuations no longer looked attractive. Equity dispersions were still insufficient for equity long shorts to make money off.

We typically don’t have a strong macro view that we require our portfolio managers to be aligned with, but we do have a strong macro view which at times advises how we allocate.

Macro and CTAs had a good 2008 as trends were strong. They are typically bad at turning points and where the market becomes choppy without trend. 2009 was tough. 2010 was tough. We avoided macro and CTAs. YTD macro and CTA’s have suffered in 2010. Their time will come, maybe, but it was not for us.

Distress was an interesting strategy in 2009. How many managers bought non performing paper? Spread compression in performing debt drove returns quite sufficiently, but that is another story. 2010 is still early days for non performing assets. We went with a manager who was able to find interesting distress situations in Europe even before the crisis. That’s good sourcing. Distress was one of the better performers in 2009. And 2010.

A tangential theme in distress is special situations such as recaps, refis, spin offs and restructurings. This plays to the particular strengths of an experienced manager in the field with an activist bent. Unfortunately, while returns have been positive, they have been below our expectations.

We expected that the volume of mergers and acquisitions would accelerate and they did. We selected a risk arbitrageur based in the US with a track record of taking very idiosyncratic risk positions and being able to structure trade expressions to optimally extract risk arb returns beyond being long or short the spread with leverage. Risk arb indices have done moderately well this year beating the general indices but our manager has done significantly better.

Convertible arbitrage had a storming year in 2009. It was clear to all that the strategy would do well given the irrational selloff in CBs in 2008. We were heavily overweight to CBs investing with a European based global multi strat convert arb fund, a US based global multi strat convert arb fund and an Asian specific CB fund. The US based multi strat had a lot more turbocharging from a MBS arb book, a SPAC book, a cap structure book and more recently a structured credit book. Their Asian fund remains a dedicated convert arb strategy.

The dislocations in the treasury market made it natural to seek to invest with a fixed income arbitrageur. Unfortunately there were not many left standing as most of them were caught in the dislocations in 2008. Only one large player remains and we allocated to them. Another smaller fund had managed to navigate the turmoil and we allocated to them also. Both funds did as expected in 2009 and are doing well in 2010, well ahead of their peer group benchmark.

The dislocations in credit markets were impossible to ignore. Given the uncertainties surrounding how markets would evolve we went for an out and out trader.

In 2008 we added a fundamental equity long short manager to the portfolio. This manager has underperformed significantly, primarily by failing to capture the upside in 2009. We redeemed from the manager in July 2010. The dogged pursuit of fundamentals in a highly volatile market driven by macro factors has led to the underperformance. We still like the manager, but we do not think that their other investors will be patient enough and we have to consider that their business is at risk from declining assets under management.

To use the word idiosyncratic is putting it mildly with one of our Asian multi strats, a fund with a paltry 80m AUM of which over 60m is the portfolio manager’s own. The fund trades equities, converts, some credit, some commodities, at some point had physical real estate and even contemplated but thankfully never invested in wine futures.

We added a couple of start up managers, both in Asian credit. One is a converts, macro and credit manager with a history of working together previously. Their venture is therefore somewhat of a reunion. The other is a liquid credit trading fund featuring one of a handful of partners of the internal hedge fund of a major investment bank which raised a substantial amount of assets in 2007 and decided to custody their assets with a now defunct bank.

We also have Asian equity exposure through a fund run by an Englishman in Mayfair. His experience running Asian equity research on the ground in South East Asia is invaluable in understanding the interplay of fundamentals and macro so important in investing in Asia.

Finally we have a very loud addition to the portfolio in the form of a global equity long short manager with a long track record at a previous firm who has successfully launched an independent venture and is generating good returns with a process that successfully combines in depth fundamental analysis with macro.

2011 Strategy Outlook

Equity valuations, especially in the US are cheap. We expect equities to do well going forward. We think that macro policy is likely to be very constructive and that this will support risky assets. Policy is heavily constrained by the fragility of the recovery and the moral hazard firmly established in 2008 when governments underwrote investors’ exposures. There is every motivation to inflate away indebtedness.

We don’t really have a view on credit but it may struggle due to the yield compression. If investors are forced to extend duration then why not infinite duration? The area we have little understanding of despite considerable study is the structured credit market. It remains a potent marginal mover of the credit market.

The mortgage market is one we have not really understood pre and post crisis. Just how financial engineers expect to model the erratic behaviour of individuals who may be driven by all manner of factors, how they can rely on information provided by lenders and not borrowers, how they can countenance the principal agency issues, is beyond our limited understanding. We can only hope to understand the systemic factors underlying the mortgage market, which means jobs and interest rates. The jobless recovery in the US is a major worry. On the interest rate front, we are quite certain the Fed’s hands are tied to low interest rates regardless of the inflation outlook. Raising interest rates at any time in the foreseeable future would destroy the mortgage market and precipitate more losses on bank’s balance sheets. I wonder how these securities were marked the last time during the so-called stress tests which so reassured the market.

Inflation versus deflation has been a debate that has risen in importance all year. The Fed has committed to low interest rates both explicitly and implicitly. Inflation expectations have oscillated. Realized inflation has been low in the US but has been more robust in Europe and emerging markets. We expect that inflation will accelerate but that it is taking a longer time to do so due to excess capacity. We have seen inflation in specific markets which are capacity constrained, such as agricultural commodities, assets, location specific supply constrained real estate, and we have seen no inflation but a commensurate increase in real output in non-capacity constrained industries such as autos. The inflation will come more generally, we think, once capacity utilization gets above the 80’s again. It will be priced into the TIPS but may not manifest in the treasuries.

Equity markets have been macro driven since mid 2008. The structure of equity correlations have gone from balance sheet strength to country risk to defensive / growth, by turns. This correlation rotation has recently broken down and we think that this is a signal that fundamental based strategies will begin to be more effective versus more macro trading strategies. As always, we have a stable of fundamental equity investors in the pipeline when we believe that fundamentals are firmly in the driving seat. For now, we are not going to preempt anything.

Fixed income relative value will remain an interesting strategy. There is much to do in the inflation space, we think, first of all simply based on the strong polarization of views about inflation, then the disagreement in pricing between treasuries and TIPS, as well as the international dynamics of demand for treasuries. We are therefore allocated to a macro relative value fund as well as a micro arbitrage fund in the fixed income space.

Risk arb remains a favored strategy. Cash levels on corporate balance sheets remain high. Management is predictable; nobody wants to return capital which they raised in panic and at high cost immediately post crisis. There is nothing much to say here but we believe that this will continue to be one of the more important strategies for the next few years.

Distress will continue to do well as the focus turns from performing to non performing assets. We would look to increase allocation to the US where we have little to no exposure. We have taken our time to analyse and monitor. Because we are specific in what we seek, we have patiently waited for true distress situations to rise in volume and to seek managers to execute the trades we want. Our European exposure is not based on opportunity but is entirely bottom up. They remain in the portfolio.

This is an incremental report and is hence brief. For more detail see:

- The recovery: http://www.hedged.biz/index.php?option=com_content&view=article&id=235:ten-seconds-into-the-future-2010&catid=1:latest-news&Itemid=63

- 2009 Review and 2010 Outlook: http://www.hedged.biz/index.php?option=com_content&view=article&id=212:hedge-fund-performance-2009-and-outlook-2010&catid=1:latest-news&Itemid=63

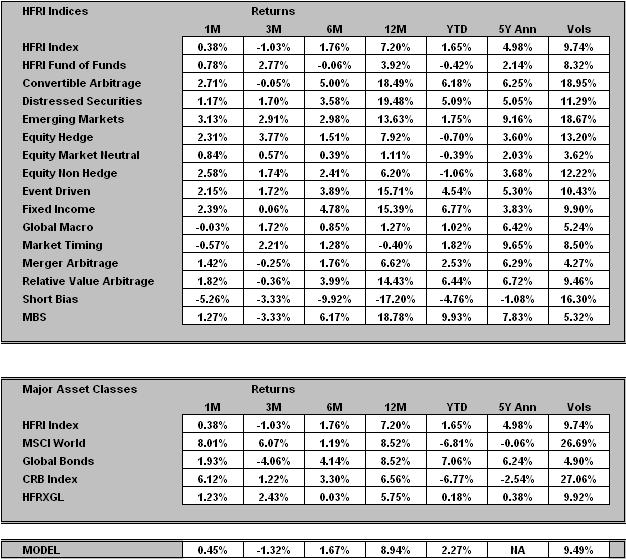

Performance*:

* Disclaimer: Returns are based on hypothetical allocations in a paper portfolio. Performance is calculated without taking into account administration or custody fees but are net of management fees of 1% per annum. There are no performance fees. Underlying fund returns are obtained from managers’ monthly reports. Future returns can be negative as well as positive.