Investment Strategy and Asset Allocation

In my earlier post of 8 October, I argued that if one had no memory and only asset allocated based on prevailing pricing, equities did not appear overvalued.

I ignored assumptions of default risk in the bonds as well as recovery assumptions which may have tipped the scales in favour of credit over equities at the margin.

Now, let’s have a look at the picture if we did have a memory and looked at the evolution of the relative attractiveness between risky assets and government securities, and between equity and credit.

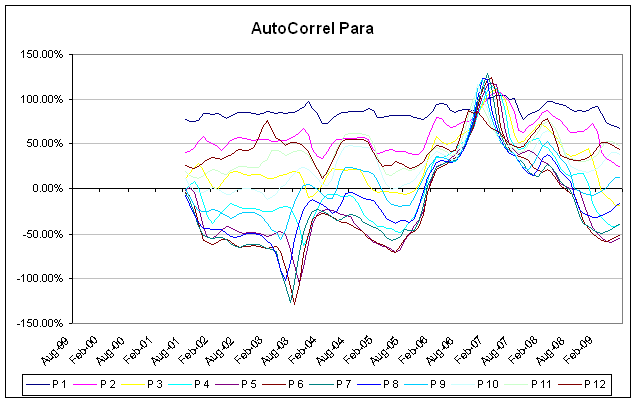

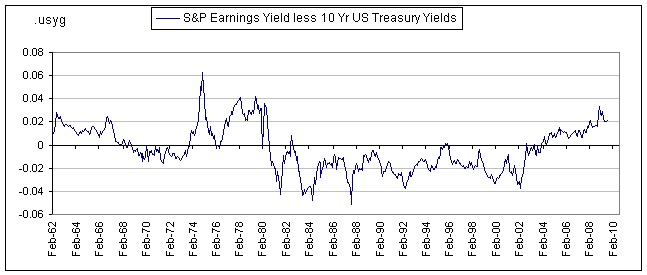

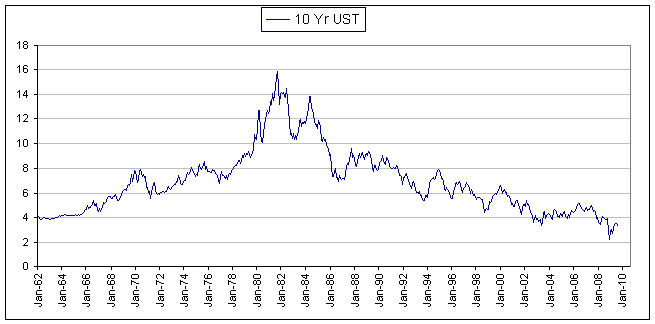

The yield gap between the S&P500 and 10 year US treasuries is as follows:

On this measure, it certainly looks like equities are more attractive than government bonds. Add to this the fact that governments are transferring risk from private balance sheet to the public balance sheet in their various financial sector rescues, that fiscal policy is running extremely expansionary and will result in higher public sector borrowing requirements, and that the scale of the problem is global among developed countries and will see competition in issuance of government securities and the argument is quite compelling. You don’t want to own government securities.

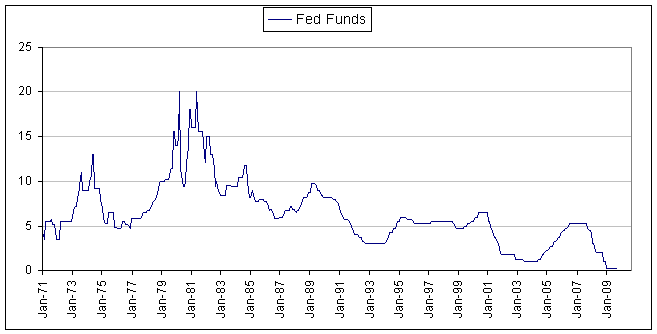

In part the bull market 2003 – 2007 was fuelled by the Fed holding rates too low resulting in the equity yield gap being too high and in fact rising through the period. Here, the Fed faces an interesting problem. As they raised rates from mid 2004 to mid 2006, the market takes it as an indication of a proactive policy likely to avert inflation and likely to promote financial stability, expectations that lead to continuing buying of Treasuries and yield products like corporate bonds. Also, ballooning USD reserves of China and Japan are recycled in effect in the form of an aggregate vendor financing from these net exporters, keep interest rates down in the US, fuelling further over valuation of yield assets.

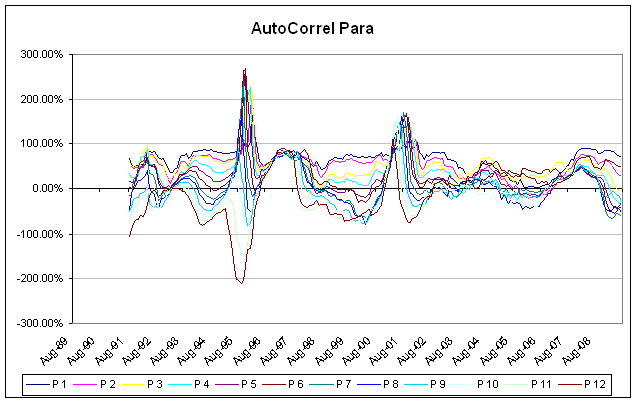

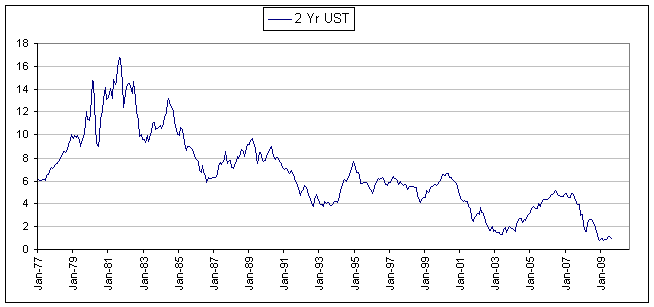

Fed Funds rose 2004 – 2006

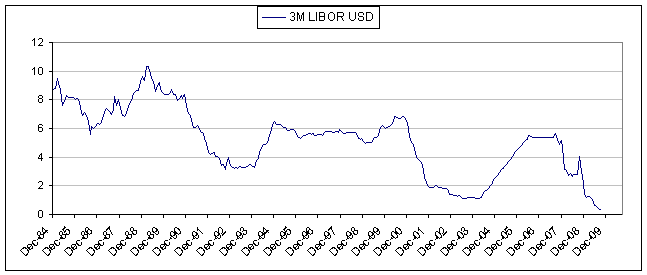

So did LIBOR, pulled by no-arbitrage pricing and proximity to Fed Funds:

But the impact at higher maturities is dampened by other effects:

And is swamped by foreign purchases of longer dated US treasuries:

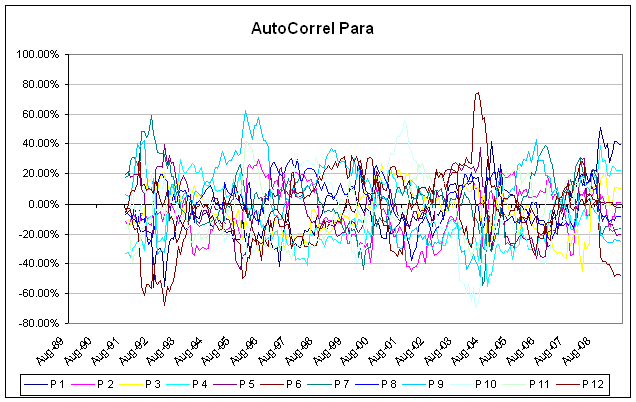

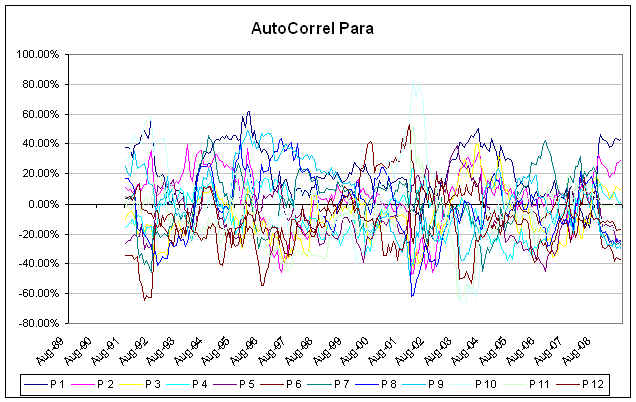

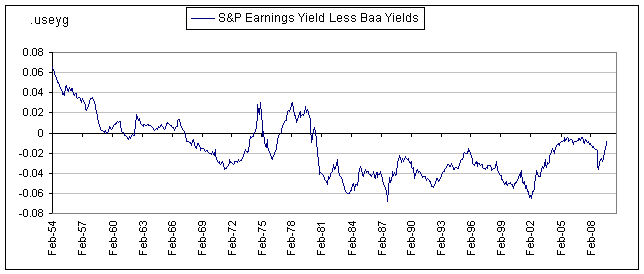

A similar comparison of S&P500 earnings yields against corporate bond yields obtains the following:

The yield gap between the S&P500 and 10 Baa corporate debt with average 10 year duration is as follows:

At least cyclically, equities are cheap relative to corporate debt. Ordinarily one would adjust for default and recovery but government bailouts may have created and entrenched a moral hazard exacerbating the situation.

Now look at the period 2004 – 2006. The Fed had already begun to raise rates but look at the impact on corporate spreads. It is minimal. Yields do rise but not significantly.

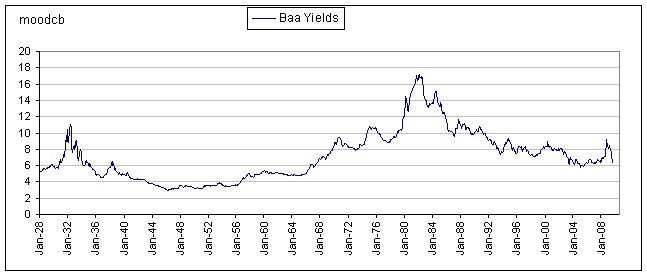

Baa Yields, Avg Duration 10 years.

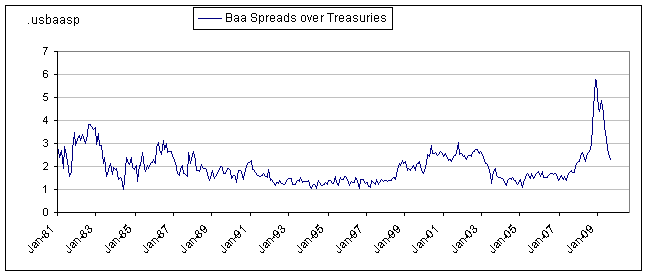

In fact Baa spreads over treasuries stayed low up until the 2008 credit crisis.

Baa Spreads, Avg Duration 10 years.

Even so, the yield gap is rising from 2002 to 2007. The gap has recovered from a sharp dip in the 2008 crisis and today stands at levels which again recommend equities over corporate debt, at least relative to historical spreads. Looking at a snapshot of levels ignores equity volatility and credit default but looking historically does address some of these additional factors, albeit not by any means precisely.

GOLD!

I know nothing about gold so I will not say anything about it. You can’t eat it, you can’t burn it, you can’t make anything useful out of it. But, you can exchange it for other stuff. So let’s do that. I’m not interested in the value of gold since it means nothing to me, intrinsically. Let’s do look at other stuff measured in gold.

Money priced in Gold:

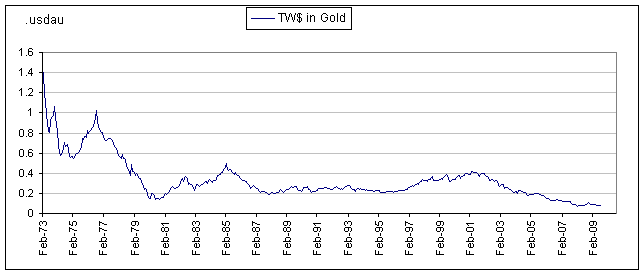

Here is a chart of the Trade Weighted USD priced in Gold:

The chart shows a debasement of the USD but a similar picture is true of GBP and EUR. JPY weakened in gold terms fro, 2005 to 2007 and has since stabilized and threatens to strengthen. As long as a government continues to print money and spend what it doesn’t have, one would expect its currency to fall in Gold terms. USE, GBP and EUR are clearly in this category.

Oil priced in gold.

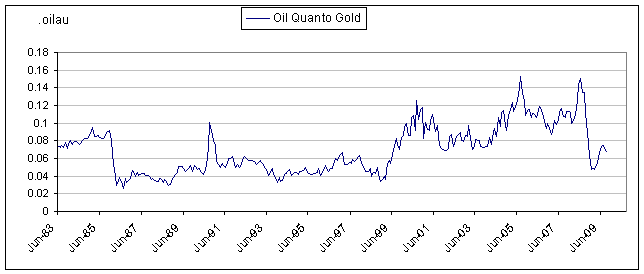

Brent quanto Gold:

The oil price is almost perfectly priced. In a range 60 – 70 USD absolute, it is priced as marginal product in industrial production. Strategically, it is where Opec wants it, any lower and it hurts the fiscal condition of many Opec countries, any higher and alternative fuels become viable. In gold terms, we see a picture that tells us little. I used to think that the oil price moved into a higher range from 2000 onwards because of the accumulation of strategic reserves by the US in reaction to 9/11 and the Second Intifada. I haven’t changed my mind but I am looking for reasons to update a stale thesis. In the meantime, the global economy, particularly the inefficient users of energy in the emerging industrial economies seem to be in recovery which will likely support the price of oil, cyclically at least.

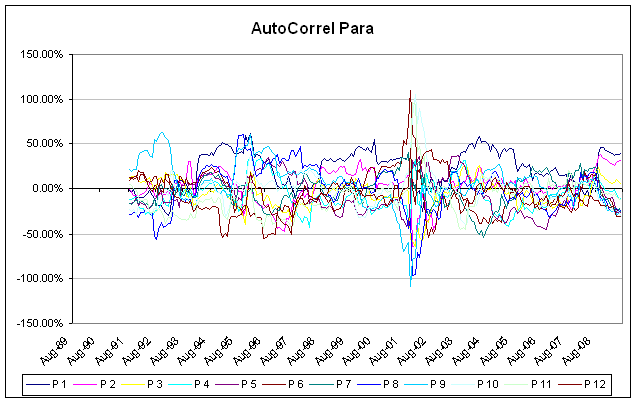

Equities priced in Gold:

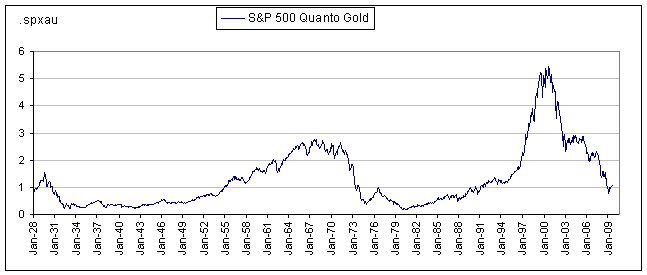

S&P500 Quanto Gold:

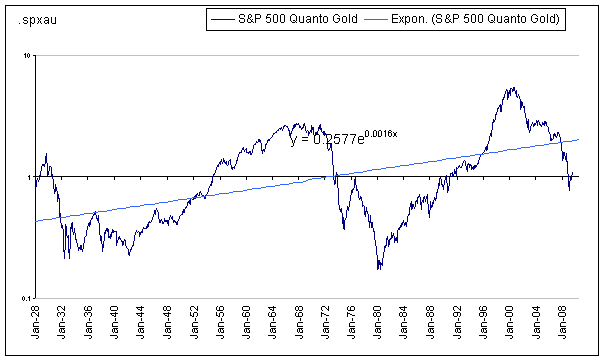

And again on a Log Scale

So here is the question phrased and rephrased: Has the economy been set back 18 years in the last 1 year? Has 18 years of progress been wiped out? Of the 18 years of equity market value (quanto gold) that has been wiped out, how much was over valuation, bubble and fluff, and how much was real value? These are clearly loaded questions the obvious answers to which are, no, equity markets have been overly discounted and represent good value. Unfortunately, there is a credible counterargument.

Can the S&P 500 go back to 650? Yes it can, and it would not look amiss on either a normal scale or a log scale. Is it likely to?

Driving corporate productivity and profits is human ingenuity. We would expect therefore that periods of decline are shorter than periods of progress. However, in gold terms, Nov 67 to Apr 80 was a protracted bear market, exacerbated if not precipitated by a USD crisis, the derailment from the Gold standard, an oil crisis and related inflation. In gold terms, we have been in an equity bear market since Sep 2000. The equity bears among us can therefore expect a potential further 4 to 5 years of bear markets in Gold terms. In Gold terms. Gold could also rise further. If quantitative easing and deficit spending continue, gold would likely rise further. Gold rises not so much because its fundamentals have improved as much as that the yardstick for measuring the value of gold, the USD or some such other fiat currency has been debased. As an inflation hedge, an industrial metal whose exposure can be directly or indirectly implied from the CPI basket would be a much more useful hedge. So too equities in the inflationary goods and services.

I will post a more detailed view on inflation but in the meantime, all I can say is that there is sufficient excess capacity in most economies that inflation is not a worry. This despite the effort of every government to debase their own currencies. There is a breaking point, however, at which confidence in a currency breaks which results in hyperinflation. Inflation is always and everywhere a confidence phenomenon.