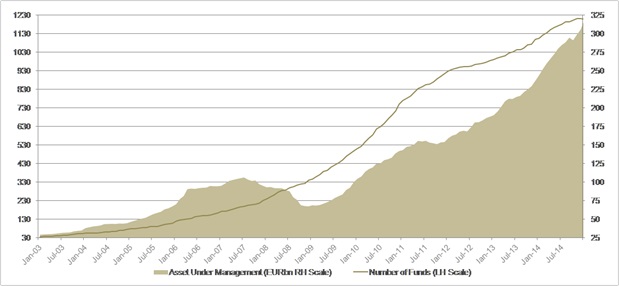

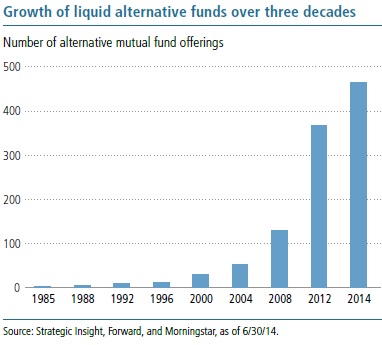

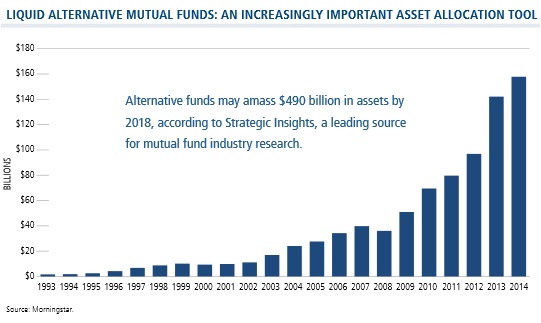

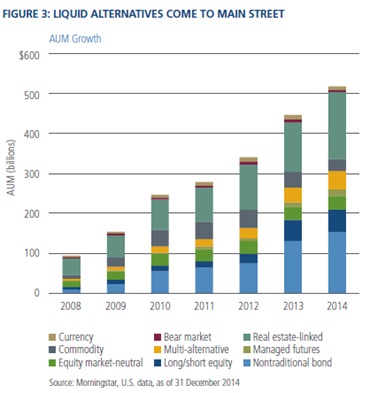

Post 2008 there has been a significant preference for liquidity. UCITS alternatives and 40 act funds were a reaction to this and assets under management have grown. Central bank liquidity has suppressed base yields, and investors have tightened spreads across multiple asset classes, notably credit. Alternative strategies or hedge fund strategies have been deployed, with mixed success, to meet demand for returns. Liquidity preference has led to some less liquid strategies being packaged in liquid fund structures.

The largest segments of liquid alternatives are credit and real estate linked funds. Not all of these strategies are liquid despite the liquidity provided by their investor pooling vehicles (funds). Liquidity has not been a problem as central banks mounted a concerted effort to inject liquidity and suppress yields. The divergence of the Fed towards a neutral to tightening stance changes the calculus. Financial market regulation also reduces dealer participation in market making further reducing liquidity in certain markets.

The importance of matching the liquidity of the underlying assets to the liquidity provided to investors in collective investment schemes may re-emerge with painful consequences.

2015 witnessed the closure and liquidation of Third Avenue’s Focused Credit Fund, a distressed debt fund investing in the less liquid end of the credit market which was inappropriately structured as a liquid fund. Other similar distressed debt funds have closed since, the most recent being Lutetium Capital.

Alternative UCITS