In November 2011 I counseled caution on the Chinese economy, expecting a serious slowdown in growth. At the same time, I was concerned about the poorly policed financial system, a concern which has not gone away, despite the recovery in other parts of the Chinese economy. While the Chinese economy has recovered, it remains at risk from a fragile financial system and excessive credit creation.

A cursory survey of the physical infrastructure growth in China, simply by visiting cities and traversing rail and road, leads one to suspect that the scale of pace of such growth and investment cannot possibly be sustained from current income but must be financed out of credit. This is almost trivially true. A cursory survey does not, however, give us an idea of the extent of credit creation. One data point is total social financing which topped 15 trillion RMB in 2012.

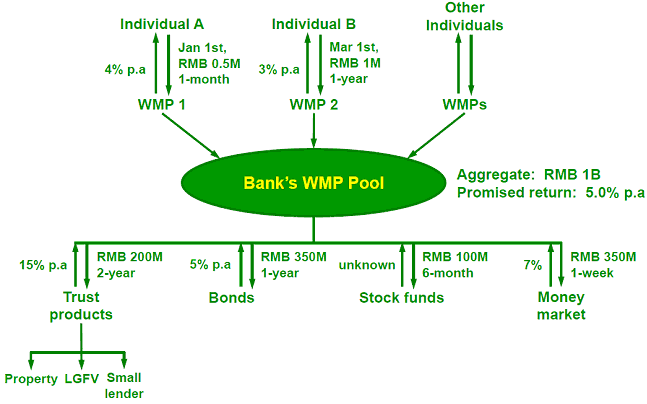

The volume and pace of credit creation is not the only area of concern. Of equal importance is the structure of credit in the economy. Bank’s share of total lending has been steadily falling, as credit creation has been transferred to the bond market and the shadow banking system. This is not a bad thing, in fact, properly done, it is a good thing. However, we already see the weakness of the LGFV’s which are often poorly structured, are supported by local governments with weak cash flows, and backstopped by banks using dodgy accounting. Trust companies are another conduit whereby dodgy assets are financed by the issue of liabilities to retail investors in search of yield and who try to escape the financial repression of artificially low deposit rates. The last mile in the credit distribution system are wealth management products offered by banks and asset management companies. Retail investors are unwilling to lock up capital and wealth management products are thus structured with appropriately short maturities quite inappropriate to the duration of the assets they finance. The documentation of wealth management products and the disclosures are often sufficiently light that misselling and misrepresentation risks are high. Basically, a large proportion of assets in China are financed through structures that resemble SIVs complete with asset liability mismatches and poor asset quality, weak credit underwriting and dodgy selling practices.

Adding to the complexity of the picture is the proliferation of credit guarantees, basically, credit default swaps with very loose margin and collateral management practices. The Chinese credit guarantee is ubiquitous for SME’s as banks tend to prefer to lend to larger firms or SOEs. Independent businesses seeking credit are forced to rely on credit guarantees.

China’s credit system is weak not for any reason other than that it has grown too quickly, and hasn’t learnt the lessons that the developed world learnt in 2008 when SIVs and CDOs blew up, CDS markets dried up and counterparty risk rose on the back of paranoia. This is a pity. The developed world behaved irresponsibly leading up to 2008 when financial innovation led prudence, but there were few examples to warn them. China, however, has copied the excesses and bad practices despite having Western history as a guide.

A Chinese Debt Obligation:

Source BoAML.