It is always a difficult time to invest. When markets are turbulent and falling, investors will tell you it’s a difficult time to invest. When markets have been rising on low volatility for as long as the current market has, investors will tell you it’s a difficult time to invest.

Why is it such a difficult time to invest when volatility is low and markets continue to rise gently? Surely these are ideal conditions for investing? Central banks have underwritten the markets for 8 years now, and even as they lessen their accommodative efforts, they do so to enable further accommodation down the road should the economy weaken. The fact that they consider conditions sufficiently robust to lift their foot of the accelerator is surely reassuring news. They are far from slamming on the brakes. The financial system which had become acutely stressed in 2007 has been repaired and is ready to resume normal service. Growth has recovered almost universally, and even international trade has rebounded and with it global manufacturing. Economic conditions look healthy. Even the chronically lethargic Eurozone has caught up and is currently outrunning the US.

Investors are worried about valuations and they are right to be concerned. Equity valuations are as high, higher in some cases, than they were in 2007 just before the crisis. The S&P500 for example trades on 21X earnings whereas it traded at around 18X pre crisis. Eurozone equities are also trading above pre crisis valuations as is India. However, equities are not universally more expensive. Nasdaq is actually cheaper today than it was 10 years ago. Chinese equities, whether listed in Shanghai or Hong Kong are also cheaper today than 10 years ago. The dominance of US companies and markets skews valuations so that taken in aggregate, equity markets are expensive.

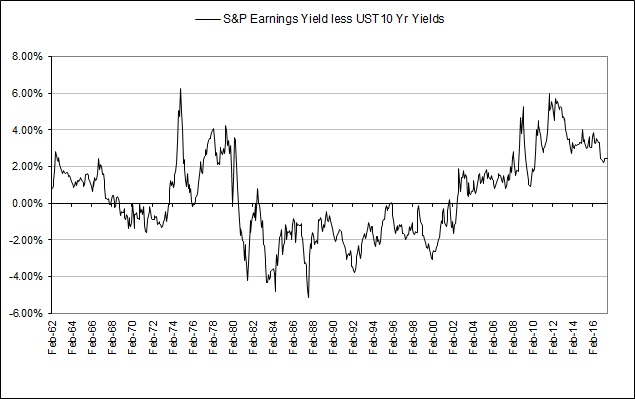

When equity valuations are seen in the context of alternatives or opportunity costs, the picture is more nuanced. The equity earnings yield premium over 10 year US treasuries finds that equities were extremely cheap in 2011 and have become more expensive since then, but remain probably in the region of fair value to slightly cheap, certainly cheaper than they were in the years 2003-2007.

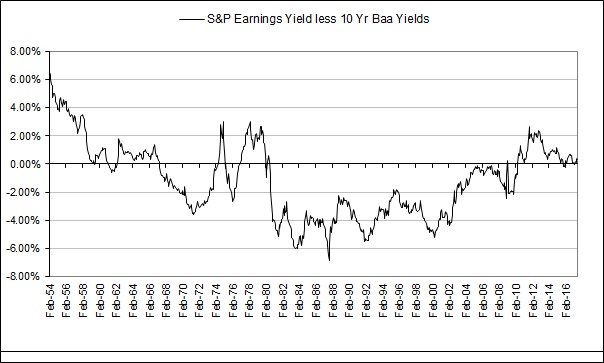

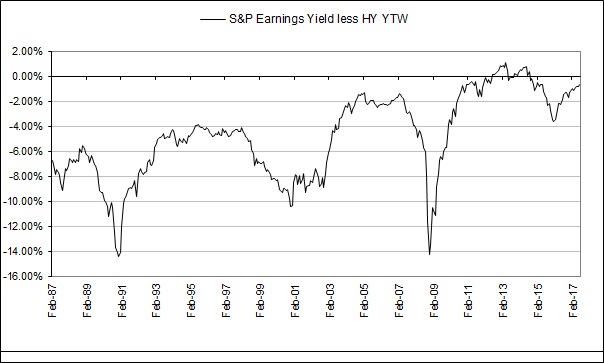

Comparing equity valuations relative to investment grade credit also finds that equities are not overvalued. In fact they may be an indication that corporate investment grade is overvalued. The same is seen when compared with corporate high yield.

Are equities expensive?

Are equities more expensive or corporate investment grade bonds? (High is cheap, low is expensive)

Which is more expensive, equities or corporate high yield?

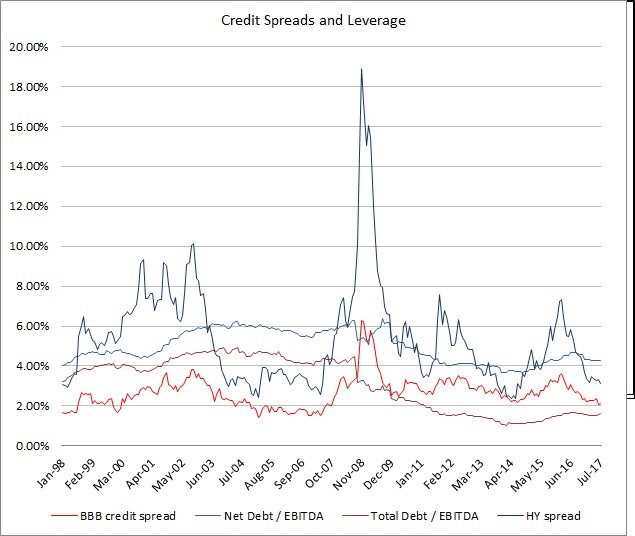

Which brings us to the complaint that bond markets yield little value. Economic conditions are healthy and corporate balance sheets have reasonable leverage. Barring some areas where leverage has surged, notably China, leverage is closely monitored and as a result companies are less likely to lever up irresponsibly. China, by the way is a bit of a special case as the leverage has increased most where the lenders are state owned and the borrowers are state owned; one might call it off-balance-sheet QE. And even here, the PBOC is trying to ‘normalize’ its policy. In the US, the Fed is clearly of the view that corporate America is able to operate under normal conditions as opposed to the ‘intensive care’ of the past 8 to 9 years.

Investors’ concerns lie not so much with fundamentals but with pricing. HY spreads are at their tightest since the crisis and IG spreads are not far off their lows (achieved in 2014). When it comes to floating rate paper, the spreads are even tighter. Fears of rate hikes by the Fed have driven investor demand for leverage loans resulting in desperate buying.

US credit spreads are tight. But leverage is receding.

Now there are ways to eke out a higher return, sometimes even at lower risk, and one can invest in hedge funds which take advantage of mis-pricings through arbitrage or relative value but alternative investments have alternative risks.

In fixed income, one can venture into the ABS market. Non-agency RMBS has done well and the nascent agency credit risk transfer market is another attractive area. Structured credit is another area where value can still be found. Subordinated bonds and preference shares are another potential area to hunt for returns. But with each basis point of additional yield comes additional types of risk. It is not that one should embrace the risks or dismiss them but that nothing is for free and the investor must satisfy their own understanding of the risks.

In the area of hedge funds, years of central bank policy has raised correlations and dampened volatility, a one-two knock out to traders seeking to buy cheap assets and short expensive ones. Even cross capital structure arbitrage yields acutely low unlevered returns forcing hedge funds to either leverage up (assuming their prime brokers or investors will let them), or print a lower return. Central bank policy has also confounded traditional transmission mechanisms between policy, the economy, and asset markets delivering global macro funds a particularly difficult environment.

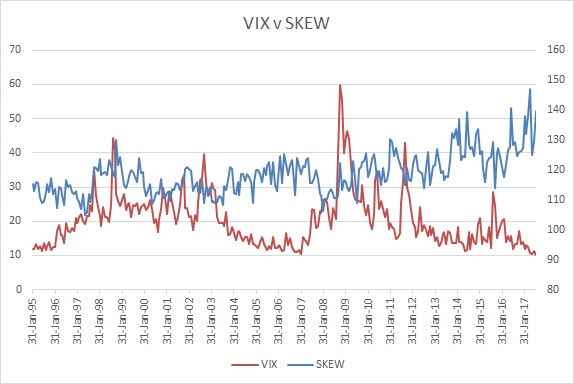

As for systemic risk and investor complacency, we recall an old chart showing both VIX and SKEW. VIX is a widely accepted indicator of investor confidence or complacency. Of late, VIX has fallen to historically low levels and seemed impervious to events of economic and political significance. SKEW, however, shows that post 2008, investors have in fact been sceptical if not cautious. VIX has been depressed by volume call writing and SKEW has been lifted by volume put buying. The divergence between SKEW and VIX are hardly a sign of complacency. Rather it is indicative of the vigilance and worry of at least a segment of investors that has pervaded markets since the crisis as investors brace for the next bust.

Complacency or vigilance? Optimistic investors will not over-supply calls or over-demand puts.

The only thing once can be pretty certain of in investing is that your wealth will not be the same as when you started. With some diligence and intelligence it should grow at a reasonable pace not far from the rate of growth of the economy or corporate profits. In the short run, volatility will dominate trend and in the long run the reverse is true. It is important for an investor to define their own style of investment and to maintain a consistent strategy lest one is repeatedly whipsawed by the market. Traffic in lower quality assets and one has to be nimble. Invest in higher quality assets and one has to be patient. It is extremely difficult to monetize both noise and signal. To make things a little easier.

*All chart data sourced from Bloomberg