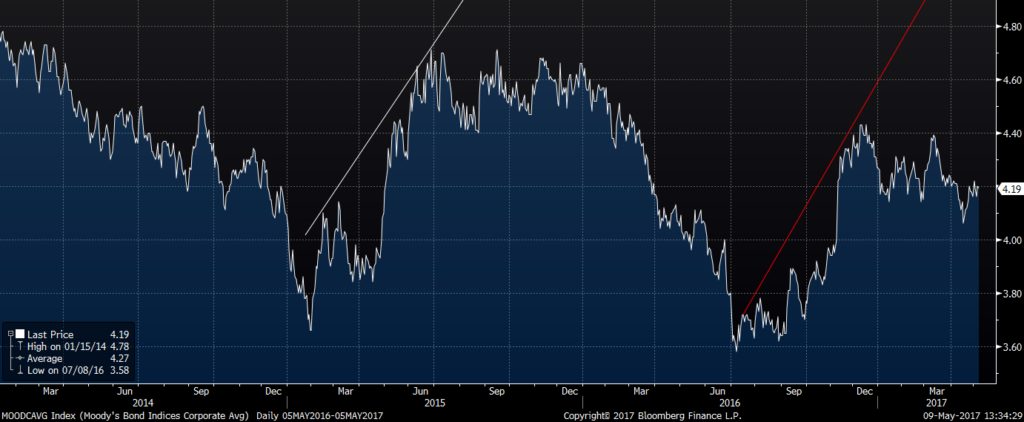

The following is a chart of the Average Yield for US Corporate Bonds. The period of early 2015 indicated by the white line coincides with a slowdown in US manufacturing PMIs.

* chart data source Bloomberg

Since mid June 2016 we have seen corporate bond yields rising as a result of rising US treasury yields, reflecting an improving economy. At the same time we have seen credit spreads compress, but not enough to make up for the rising treasury yields.

Come November and Trump winning the US Presidential Election, US treasuries spiked higher, raising the total debt financing cost for US corporate borrowers. The hike is equivalent to a 50 basis point rate hike (softened by some compression in the credit spread), and taken together with the fact that yields had been rising since July, businesses were facing increased debt financing costs of over 1%. That’s bound to put the brakes on growth to some degree.

The Fed meets in mid June, a month and a half away. The probability of a quarter point rate hike is 92%. Corporates, however, don’t all borrow at the short end. The impact on longer maturities is likely to be distributed and moderated. The signal that the Fed would be sending, that the economy was in good health, will likely compress the credit spread a little more, softening the blow.

But if an explanation is sought for the recent slowdown in growth, and to put it in context, a very moderate slowdown it is, look no further than that financial conditions have tightened, ironically on expectations that Trump’s policies would turbocharge growth and inflation.