Average hourly earnings are growing at 2.7% YOY, well below the 3.6% growth rates seen pre crisis 2008. The unemployment rate has fallen steadily from 10% during the crisis to 3.8%. The JOLTS Quits Rate (which measures voluntary quits, presumably in search of better prospects) has risen steadily since 2009 to 2.3%, near its post crisis high. Skeptics of the recovery in the US labour market can point to few metrics of weakness, prime among them a stubbornly low participation rate (currently 62.7%).

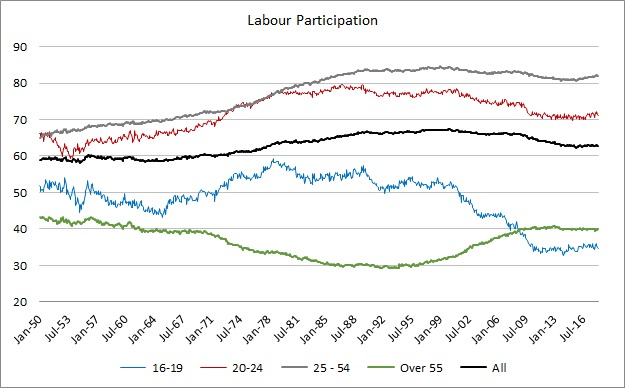

The following chart shows the participation rate for the various age groups of the labour force. Apparently the age group most responsible for reducing the participation rate is the 16-19 year age group. Second is the 20-24 age group. These two groups have seen participation rates fall steadily since the late 1990s, presumably as the emergence of the knowledge economy encouraged greater investment in education and development of skills resulting in a later entry into employment.

The 25-54 segment participation rate may have fallen from 84.6% in 1999 to 80.5% in 2015 but it has since recovered to 81.8%.

From this picture of the US labour market, it appears that the market is tight.